Whakatipu Rawa

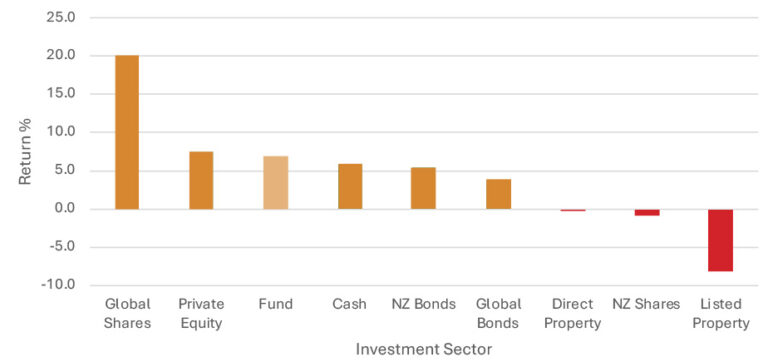

Over the year to 30 June 2024 global share markets surged with the MSCI World index returning over 20% in New Zealand Dollar terms. Tech stocks’ share prices rose because of the expected Artificial Intelligence boom. Technology stocks in the US were up 30% over the year, four times higher than the rest of the US share market as measured by the S&P500 index and driven by very few companies.

Domestically our share market underperformed the rest of the world ending the year down 0.8%.

Bonds saw more modest gains over the 12 months to June 2024 with domestic bonds outperforming global bonds (hedged into NZ dollars). The NZ dollar appreciated strongly against the Yen over the year (up 10.7%) but depreciated against the US dollar and Australian dollar. Overall, foreign currency movements detracted around 1% from unhedged global equity returns.

The Reserve Bank of NZ held the OCR at 5.5% over the year in an effort to cool inflation that has continued to fall, ending at 3.3% for the 12 months to 30 June 2024. Returns from the investment sectors that we invest into and the Fund’s overall return for the year are

shown below:

Asset Allocation

In such a volatile investment environment we focussed our fund managers on risks to our portfolio, including an understanding of the geopolitical environment. In October 2023 we redeemed our underperforming holdings in Mercer (the Socially Responsible Growth Portfolio) to fund new investments. At the start of the Financial Year, we put our cash to work through new investments into:

– an additional Private Equity fund managed by Castlerock LP,

– a Global Equities fund managed by Te Ahumairangi Investment Management, and

– a commercial property fund managed by Hāpai.

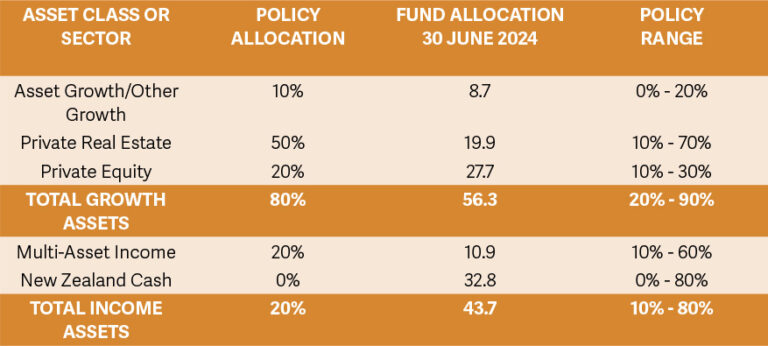

We also continued to research several private investment opportunities and optimise the higher term deposit rates for cash. The table below shows the asset allocation TMRI is working towards for growth and income assets.

Growth Assets are invested into funds such as equities (shares), property, and private equity. Investment into Growth Assets is for the longer term to earn a higher return on investment. Multiasset growth funds are mostly invested in Growth Assets but allow the fund managers the ability to invest in income assets to preserve capital.

Income Assets are assets such as fixed interest and cash. These are usually more liquid and can be drawn upon at short notice. Multi-Asset Income Funds are invested mostly into Income Assets but allow the fund managers to invest in Growth Assets to benefit from dividends and other distributions and generate some capital growth.

During this financial year, RTMRI returned a dividend of $1.035m to Rangitāne Tū Mai Rā Trust in accordance with its ongoing obligation to provide a cash distribution of 3% annually to the Trust.

FUNDS – as of 30 June 2024

Salt Sustainable Global Shares Fund

As of 30 June 2024, $1.2m was held with investment funds manager Salt Funds Management within the Salt Sustainable Global Shares Fund. The Fund targets a portfolio of global companies with high total return potential and high Environmental, Social, and Governance (ESG) factor scores. Salt runs the Fund in New Zealand but the shares in it are selected by Morgan Stanley Investment Management, one of the largest fund managers in the world. Its top 5 holdings as of 30 June 2024 were: tech giant Microsoft; multinational software company SAP, multinational financial services corporation Visa, Fortune Global 500 professional services company Accenture and Alphabet Inc, the parent company of Google.

Salt Sustainable Income Fund

As of 30 June 2024, $1.9m was held with investment funds manager Salt Funds Management within the Salt Sustainable Income Fund. The Fund aims to provide quarterly income more than bank deposit rates, along with a positive capital return on capital on a rolling three-year basis. The Fund has a diversified mix of growth and defensive assets, with a focus on investments with strong ESG credentials and reliable income generation. Its top five investments as of 30 June 2024 were: a global bond futures contract to provide some protection from market falls, a 5-year US treasury note, Fisher & Paykel Healthcare; Goodman Property Trust, and Infratil.

Mint Diversified Income Fund

As of 30 June 2024, $2.4m was held with investment funds manager Mint Asset Management within the Mint Diversified Income Fund. The Fund invests in New Zealand and international fixed interest, cash, Australasian and international equities, and listed property. The Fund aims to deliver a total return (through a combination of income and capital growth) more than New Zealand’s inflation over the medium to long term. The top five investments were bonds issued by the New Zealand Government, Housing New Zealand, Spark, Vector, and Contact Energy.

Hillfarrance

TMRI committed $1m to the Hillfarrance Venture Capital Fund I and has contributed 100% of this commitment as of 30 June 2024.

Continuity Capital Private Equity

TMRI committed $5m to Continuity Capital No. 4 Fund LP in November 2018 and $5m to Continuity Capital No. 6 LP in September 2021. Continuity Capital is a private equity manager of managers that selects best-of-breed private equity funds in Australia and New Zealand. Continuity Capital’s main focus is

on the purchase of interests in private equity funds that have completed their investment program, hold quality assets, and can be purchased at attractive prices.

Continuity Capitals ‘fund-of-funds approach gives excellent diversification between Australian and New Zealand companies, a wider range of businesses, and different vintages of Private Equity deals. For the No. 4 Fund, TMRI had contributed $4.3m of the $5m to date and received $3.0m in distributions. The fund has provided a 13.1% p.a. return over the period of investment since November 2018.

TMRI has contributed $2.8m of the $5m committed to the No. 6 Fund. The Fund is still in its early stages and so has yet to make a distribution. The return to date has been 0.5% p.a. Private equity funds tend to have relatively high costs in the early stages of their development, with Fund returns increasing over time.

Te Puia Tapapa Investment Fund

This fund was set up by several iwi and Māori groups to invest directly into private businesses in New Zealand with NZ Super and other high-quality direct private equity investors. The fund has a proposed term of 15 to 20 years. The model was set up to take advantage of very high-quality partners who would provide access to very high-quality investment opportunities at a low cost. The fund had an initial minimum investment of $1m. TMRI agreed to join the fund at the minimum investment level.

New Investments made over the Financial Year

Castlerock Partners LP

As of 30 June 2024, $1.8m was held with Castlerock in the CastleRock Partners Limited Partnership. Castlerock invests in established New Zealand private companies targeting a cash distribution of 8.0%. per annum. The companies invested in as of 30 June 2024 were: Majestic Horse Floats, The Depths (master franchiser of HELL Pizza), Vivo Hair & Skin Clinics, Tile Depot, and Brooklands Pet Products.

Te Ahumairangi Global Equity Fund

As of 30 June 2024, $2.3m was held with investment funds manager Te Ahumairangi within the Te Ahumairangi Global Equities Fund. The Fund targets a portfolio of investments in 150-180 listed companies that are based in developed economies around the world. Te Ahumairangi favors investing in lower-risk companies that produce stable profits and believes that the fund is likely to withstand market downturns better than the average global equity fund. Its top 5 holdings as of 30 June 2024 were: tech giant Microsoft; the world's second-largest telecommunications company Verizon Communications; tech giant Apple, Alphabet Inc., the parent company of Google and British multinational utility company National Grid.

Hāpai Commercial Property LP

As of 30 June 2024, $1.0m was held with Hāpai in the Hapai Commercial Property Limited Partnership. This fund invests directly in commercial property and only accepts Māori/Iwi investors. It focuses on good location, high-quality buildings, and strong tenant counterparties with flexibility across the industrial, ground lease, office, and bulk retail sectors. We consider this investment to be an intergenerational, income-producing asset rather than a long-term fund that will one day be sold to provide capital for other purposes. The fund makes monthly income distributions of around 4.8% per annum.

Our Values

Mahi tahi me te kōrero tahi

Working together through honest communication

Kanohi ki te Kanohi

Being present with all people with whom we do business.

Whanaungatanga

Acknowledging our connections to whanau and global communities of people.

Mana Motuhake

Valuing our autonomy as Rangitāne and within the rohe of Tamaki Nui ā Rua and Wairarapa.

Te Mana Tika

Striving for the best outcomes for Rangitāne.